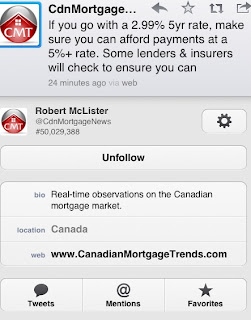

A interesting tweet this afternoon from Canadian Mortgage Trends...

"If you go with a 2.99% 5yr rate, make sure you can afford payments at a 5%+ rate. Some lenders and insurers will check to ensure you can."

Email: village_whisperer@live.ca

Click 'comments' below to contribute to this post.

Please read disclaimer at bottom of blog.

Is it because of the upcoming OSFI rule that says banks will qualify borrowers on 5-year fixed "benchmark" rate?

ReplyDeleteBtw, is benchmark = posted = undiscounted?

That must be it, discounted vs. posted rate. Posted is undiscounted. On face value that tweet is confusing.

ReplyDeleteThe interesting meta-point here is the concern that people getting mortgages are so tight that just a difference between discounted vs. posted rate can be the difference..Scary really.

Second that CanAmerican. That is a little worrisome. Or is it that people are actually cheap at heart even while they are foolishly blowing the wad on a lifetimes worth of mortgage expenses at the top of the market.

DeleteGot to make it up some where I suppose!

I love the implication that they weren't checking before. This is what we call a teaser rate ARM down in the states.

ReplyDelete