In just one year, Vancouver house prices have dropped by 12%, and unit sales are plummeting in both Vancouver and Toronto. How the meltdown will play out this fall

Last spring, Keith Roy noticed his phone wasn’t ringing so often. The Vancouver real estate agent typically booked at least 10 showings a week for the properties he sells in the city. But requests gradually slowed to a trickle. Something was up. His suspicions were confirmed as he watched the market data roll in. On the desirable west side of Vancouver, which Roy considers a bellwether for the region, home sales fell and listings rose. This continued for four straight months. In July, Roy took to his blog to issue an unusual proclamation for a real estate agent: anyone thinking about selling should cash out now. By then, Roy had even sold his own home, convinced it was about to decrease in value. “This is Econ. 101,” he says in an interview. “Supply is up, sales are down. Prices will adjust.”

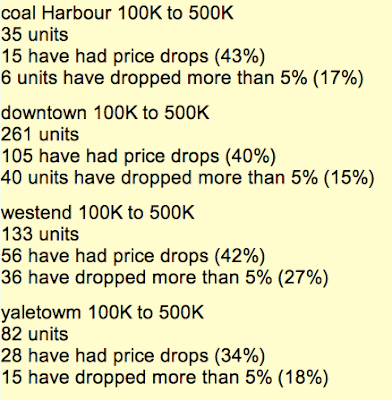

Roy’s post, which he edited after offending a few realtors, should be viewed with some skepticism. It does, after all, encourage potential sellers to call a real estate agent—and hey, why not call Roy? But he may be right that the Vancouver market has peaked. In August, the number of sales in Greater Vancouver fell 21.4% from the previous month, after dropping 11.2% in July and 17.2% in June. The Real Estate Board of Greater Vancouver chalked it up to a “summer lull,” but the numbers suggest a trend that can’t be dismissed as simply seasonal. Last month, unit sales were the lowest for any August in the past dozen years, and nearly 40% below the 10-year August norm. Even more worrying, the average home price in Vancouver is now down more than 12% from a year ago—a worrying sign for the country’s priciest city.

People have been predicting a crash in Vancouver for years, of course. What’s different now is the growing number of trends suggesting its imminence. The poor global economy is souring foreign investors’ appetite for expensive property overseas. The federal government, meanwhile, is trying to tame the market by tightening mortgage lending standards and warning the public at every opportunity that Vancouver is a risky city for buying real estate. Interest rates are still low, but the Bank of Canada keeps promising to raise them, which would quickly lower affordability. All of which leads David Madani, an economist with Capital Economics, to conclude: “The Vancouver market has cracked.”

Vancouver won’t be the only one. The next market to crack will be Toronto, starting with the city’s overheated condo segment. Overall sales of existing homes were down by 12.4% this August over last, and condo sales have fallen by double digits for three months in a row. The pre-construction condo sector is also weakening, with sales down 21% in the second quarter. Overbuilding is a major concern: a record 52,695 units are currently under construction, with another 35,000 in the pipeline, a rate that economists say is well ahead of demographic trends in the region. Investors also play a big role in the Toronto condo market, raising concerns that waves of them will try to cash out at the same time.

For months, policy-makers have expressed concerns about the country’s two biggest real estate markets. Now it’s clear that trouble is ahead. The weakness in both cities marks the start of a reversal in the long boom for Canadian real estate. The doubling in home prices that happened over the past 10 years is not likely to repeat itself. Royal LePage even conceded in a July report that the Canadian housing market has reached a “tipping point.” Forecasts from private economists vary widely. Some are calling for relatively flat prices, while Madani at Capital Economics predicts a 25% decline in Canada’s major cities over the next few years. No markets will feel the slowdown more than Vancouver and Toronto.

What’s surprising about the weakness on the West Coast is the absence of any change in economic fundamentals, such as a spike in unemployment, to explain it. The Vancouver market was cooling even before the latest round of mortgage tightening by Ottawa, which took effect in July.

Nevertheless, theories abound. One explanation favoured by realtors is that foreign investors, particularly those from China, are pulling back. Though there has never been hard data on the presence of wealthy Asian investors, enough anecdotal evidence exists to suggest they have played at least some role in the multimillion-dollar home segment. There are a few reasons why their enthusiasm could now be dampening. China’s economy itself is slowing down and its government imposed new rules that make it more difficult to move money out of the country. “People are much less bullish right now, especially people overseas,” says Brian Persaud, a Toronto real estate agent and investor. “They’re just getting wisps of the story from the big newspapers about how crazy the Toronto market is. So they’re holding off.” In Canada, the banks are also taking a much closer look at the income and assets of wealthy buyers before issuing huge mortgages, according to Roy. “It used to be if you showed up from China and said you owned a business, the bank would just give you the 80% financing,” he says.

A change in buyer psychology may also be occurring, says Madani. “I don’t think there are enough people now who believe we can continue these outsized price gains we’ve seen over the past decade,” he says. “As those expectations change, potential buyers step back.” With Finance Minister Jim Flaherty and Bank of Canada governor Mark Carney constantly warning about Vancouver real estate, it’s not surprising their pleas for restraint are being heeded.

If this change in mindset truly takes hold, the entire Vancouver market will be affected, not just the multimillion-dollar homes. The city’s real estate has always been mind-boggling to outsiders, but reached a particularly confounding peak this year in terms of affordability. The median house price in Vancouver is 10.6 times greater than the median income, according to urban policy consulting firm Demographia. That makes it the second-most-unaffordable major city on the planet after Hong Kong. The only way to account for the market becoming so detached from fundamentals, in Madani’s view, is a pervasive belief among buyers that prices will keep rising. “Vancouver is far, far beyond what anyone would expect, based on trends in immigration, income or interest rates,” he says. “That’s just not sustainable.”

Of course, easy access to credit is necessary for people to act on their beliefs. Interest rates have been at record lows since the financial crisis in 2008, making it relatively easy to obtain large mortgages. Rates have, in fact, been falling steadily since the 1990s, helping push the home-ownership rate in Canada to a record high of 68.4%, according to Statistics Canada. Household debt has ballooned, whereas wages have not. “If home prices rise substantially above income growth, the only way you’re bridging that gap usually is through mortgage debt,” says Ben Rabidoux, an analyst with boutique research firm M Hanson Advisors.

Some have taken issue with the notion that cheap credit alone is responsible for Vancouver’s exorbitant home prices. Central 1 Credit Union in Vancouver produced a report in June arguing that lack of supply and land constraints explain the pricey local real estate market. As a coastal city, Vancouver just can’t expand easily to accommodate population growth. Rabidoux isn’t convinced by that argument. While he agrees that Vancouver will always command a premium because of its geography, land constraints haven’t exactly impeded construction. Vancouver added one new dwelling for every two additional residents between 2001 and 2011, which is only slightly behind the national average. Secondly, a lack of supply should also push up the average rent in the region. But while the average resale home price has jumped nearly 128% since 2000, rents have risen by just 16.7%, as measured by the Consumer Price Index. “In order to sustain prices at these elevated levels, you need a continuous supply of new buyers willing to take that mortgage debt, and [able to] get it cheaply,” he says. Those buyers may not be forthcoming. Interest rates will inevitably rise, as the Bank of Canada keeps pointing out, and the federal government has instituted numerous changes over the past few years that will make a home purchase more difficult for first-time buyers.

“It seems like Vancouver is past the tipping point,” says Sonya Gulati, a senior economist with Toronto-Dominion Bank. Gulati estimates the market is overvalued by 15% to 20%, and says prices could fall by an equivalent amount over the next two to three years. Rabidoux foresees an even greater decline, perhaps a 30% to 40% fall in average price. The weakness in sales and the rise in inventory is uncomfortably similar to the market drop in late 2008, he says. Back then, the Bank of Canada slashed interest rates and the federal government launched a program to repurchase mortgages from the banks, which sent the housing market rallying. This time, the authorities are taking away support for the housing market. In the past four years, the maximum amortization period for government-insured mortgages has fallen from 40 years to 25. Such tightening makes an immediate rebound unlikely.

While Vancouver took a dive, Toronto has continued to set new price records. But it’s only a matter of time before it, too, slows down, particularly its red-hot condo market. Charles Hanes, a Toronto real estate agent for more than three decades, doesn’t like what he’s seeing today. There has been a big surge in so-called VIP sales events, in which condo developers offer agents and their clients the opportunity to purchase pre-construction units before they go on sale to the general public. Such events cultivate a faux sense of exclusivity and create an urgency to buy immediately, Hanes says. Lately, developers seem increasingly desperate, willing to accept low down-payments and throw in special offers, such as free maintenance for a year, to entice buyers. “That’s a sign the developers know things aren’t rosy. They don’t give anything away—ever,” he says. But what most worries him is that investors are far too exuberant about condos. Typically, investors are concerned about “cash flow,” the money earned through rental income. But prices for new units in Toronto are so high that it’s tough for investors to use rental income to cover the mortgage and maintenance fees and still have something left over for themselves. They’re essentially banking on one thing: price appreciation, which is more akin to speculation. “They’d be better off going to a craps table at Casino Rama,” Hanes says.

The economics started turning negative for new condo investment in Toronto a couple of years ago, but construction boomed nevertheless. There are 343 condo projects under construction or in the sales phase, a record for the Toronto area. (For comparison, there are approximately 20 underway in Chicago.) Over the coming years, more than 87,000 units will be completed, according to research firm Urbanation. The good news is that nearly 80% of those units are already sold. But a large number of those buyers are likely investors who may try to flip their units upon completion. Worse, they could panic when they realize that rental income alone isn’t enough to turn a profit, and flee the market. That would result in an additional supply glut, sending prices down substantially. Signs of oversupply are already showing up. Right now, “people who have bought new condos as an investment are having a difficult time selling them once the building is ready,” says Toronto agent Brian Persaud.

Anticipating what investors will do—and even how many of them are active in the market—is tricky. Don Campbell, founder of the Real Estate Investment Network, a membership-based education and research outfit for individual investors, says those in his network who have purchased new condos tell him they’re financially sound enough to deal with monthly losses until prices rise and they can make an exit. Campbell himself is dubious. “They’re going to be disappointed because the market is not going to perform as well as it has over the last four years,” he says. “The incredible number of units that are going to be coming on the market over the next little while will really start to put a damper on the average sale price of the new condos.”

Not everyone shares these concerns. Royal Bank of Canada put out a report in July that argued the booming condo market “does not imply a bubble.” According to RBC, the influx of new residents to Toronto over the next few years will be enough to populate the tens of thousands of condo units. A “structural shift” in housing is also happening. Few single-family homes are being built in the city today, which means young families will have to turn to condos.

There are caveats to both arguments. Immigration to Toronto is slowing, with newcomers increasingly choosing to settle outside the traditional destinations of Toronto, Vancouver and Montreal. And the average condo size in Toronto is actually shrinking, making such units less attractive to families.

Toronto prices are still on fire, but even there, some buyers are noticing a slight cooling. Jean Farrugia and her boyfriend have been house hunting since spring, and she’s noticed that recently selling prices have drifted down closer to asking prices. “Some people are buying for $5,000 or $10,000 over asking, whereas in the spring time that was nearly impossible to find.” Farrugia believes that rising interest rates will drive overextended owners to sell. “And I think that will cause prices to go down.”

What’s happening in Toronto and Vancouver today marks the start of a much broader slowdown in housing. Affordability is becoming an issue in other cities, especially Montreal, Kelowna and Abbotsford, B.C., according to Demographia. Nationwide, the average home price is 5.6 times the average income, says Madani, whereas the norm stretching back to 1975 is 3.5. He admits the price-to-income ratio is not a perfect measure, but says it’s one clear warning sign the market is overheated. Prices ultimately have to fall in line with income. The federal government’s mortgage-tightening efforts will cool the market further, and borrowing costs will rise at some point, slowing demand in a country where the average household debt is already more than 150% of income.

We’re starting to see the signs of a cool-down already. National home sales are falling back in line with the 10-year average, and the Canadian Real Estate Association reported the average home price fell 2% in July compared to the same period the year before. Some markets will no doubt perform quite well over the coming years, as real estate is inherently local, but they will likely be bucking a national trend. Scotiabank estimates Canadian home prices will fall 10% over the next two to three years, followed by a long period of modest gains.

After past housing booms in Canada, the subsequent hangovers lasted many years. The average price in Vancouver fell by more than 20% in real terms between 1995 and 2001 after a steady run-up. Real home prices fell by the same amount during the 1990s in Toronto. Scotiabank, for one, isn’t forecasting anything that dramatic, but even a modest slowdown will affect the economy. People who buy homes spend more on home-related items, and the housing sector has contributed significantly to the country’s economic growth over the past decade. That support would largely disappear. A U.S.-style crash is not on the horizon, but that doesn’t mean Canada won’t feel some pain.

A price adjustment may sound scary, but some say it’s necessary to restore affordability to the housing market and stop Canadians from piling on debt. “We’ve had a very good run in housing over the last decade,” Madani says. “At some point, it just runs out of gas.”

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)