====================

UPDATE: The marketing firm for Three Harbour Green has responded to today's post. You can see their response here.

====================

The investment world calls it the pump and dump.

UPDATE: The marketing firm for Three Harbour Green has responded to today's post. You can see their response here.

====================

The investment world calls it the pump and dump.

It's a stock selling tactic that involves artificially inflating the price of an owned stock through false and misleading positive statements in order to sell the cheaply purchased stock at a higher price. Once the hype kicks in, the stock is "dumped".

Critics of the real estate industry have often wondered aloud about the term 'Sold Out' when it's applied to condo developments.

Is it sometimes used as a 'pump and dump' tactic?

What does "Sold Out" really mean?

Is it sometimes used as a 'pump and dump' tactic?

What does "Sold Out" really mean?

Ask the average Joe/Josephine potential buyer on the street what they think when they read that a 100 unit development is "Sold Out", and she probably believes it means all the units in a development have been sold to like-minded purchasers.

Once "Sold Out", the cachet of the property increases with implied high demand.

Once "Sold Out", the cachet of the property increases with implied high demand.

But what if that property isn't really "Sold-Out"?

What if a theoretical developer, in the face of lagging sales, holds on to over 40% of the units in a development in order to create scarcity in the marketplace?

Sure... all of the units made available for sale have been sold. But if the public knew a developer was holding on to almost half the units in his building for sale at a later date, would keeping that information from them constitute... deception?

Ponder that while we add another dimension.

What if the aforementioned theoretical developer then begins selling his withheld units, one at at time. and as part of the marketing of those units he advertises that all other units in the development are 'Sold Out'?

Would potential buyers pay more than they would have if they had known almost half the units in a development were still held by the developer waiting to be sold?

Last Saturday the following advertisement appeared on page B4 of the Vancouver Sun.

Three Harbour Green has announced that the Penthouse in their building is available for $22,300,000.

Three Harbour Green is a Coal Harbour neighborhood development with 81 suites on 32 levels.

Three Harbour Green is a Coal Harbour neighborhood development with 81 suites on 32 levels.

In this advertisement potential buyers are told - in blue hilight - "Regrets all tower and townhome suites are SOLD OUT"

But is that really the case?

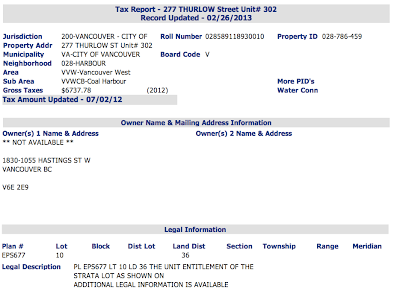

A anonymous reader of this blog sent us what appear to be current tax reports (dated February 26th, 2013) for properties at Three Harbour Green (277 Thurlow Street).

This is a screen shot of an alleged tax report for Unit # 3101. It's the report for the Penthouse suite - supposedly the only unit left available for sale:

As of February 26th, 2013 it says the unit is registered to 1830-1055 Hastings Street, the address of the developer of Three Harbour Green: ASPAC Developments Ltd.

That would make sense since Three Harbour Green is advertising the property for sale.

That would make sense since Three Harbour Green is advertising the property for sale.

There's just one problem. Similar reports appear to be on file as of February 26th, 2013 for Unit's #102, 103, 104, 301, 302, 502, 602, 701, 702, 703, 801, 902, 1001, 1003, 1102, 1203, 1301, 1303, 1401, 1403, 1701, 1702, 1801, 1901, 1903, 2003, 2103, 2301, 2402, 2403, 2701, 2801, and 2901.

These alleged tax reports appear to indicate that the above listed 34 suites (of the total 81 suites at Three Harbour Green) continue to be registered to the address of the developer, ASPAC Developments Ltd.

These alleged tax reports appear to indicate that the above listed 34 suites (of the total 81 suites at Three Harbour Green) continue to be registered to the address of the developer, ASPAC Developments Ltd.

Here is one of those tax reports, allegedly for Unit #102:

For Unit #302:

For Unit #701:

And Unit #2301:

They all appear to be registered to 1830-1055 Hastings Street - the address of the developer of Three Harbour Green: ASPAC Developments Ltd.

How can this be if "all tower and townhome suites are SOLD OUT"?

I guess it's possible that these tax reports we've anonymously received are fake.

Or, perhaps, Chinese New Year (CNY) did produced a wave of sales and all 33 remaining units (everything except the Penthouse) were sold; the February 26th tax reports merely waiting to be updated with the new registered owners.

But didn't we cover the whole disappointing CNY sales season after the MAC Marketing fiasco?

For Unit #701:

And Unit #2301:

They all appear to be registered to 1830-1055 Hastings Street - the address of the developer of Three Harbour Green: ASPAC Developments Ltd.

How can this be if "all tower and townhome suites are SOLD OUT"?

I guess it's possible that these tax reports we've anonymously received are fake.

Or, perhaps, Chinese New Year (CNY) did produced a wave of sales and all 33 remaining units (everything except the Penthouse) were sold; the February 26th tax reports merely waiting to be updated with the new registered owners.

But didn't we cover the whole disappointing CNY sales season after the MAC Marketing fiasco?

So here's our question.

Does Three Harbour Green and ASPAC Developments Ltd still own all of these suites?

Does Three Harbour Green and ASPAC Developments Ltd still own all of these suites?

If these tax reports are genuine (and CNY didn't produce a wave of sales that swept away all the inventory at Three Harbour Green), is advertising the development as "Sold Out" with "regrets all tower and townhome suites are SOLD OUT" misleading?

Surely there are some kind of standards in the real estate industry for this sort of thing?

==================

Email: village_whisperer@live.ca

Click 'comments' below to contribute to this post.

Please read disclaimer at bottom of blog.

A reporter should call the developer and ask him/her point blank: is this place sold out as in buyers have purchased all units? or not sold out. The follow up question is if the development is not sold out, why do they advertise that it is? The follow up question is why do they think it is okay to publish a clearly misleading ad in British Columbia's leading newspaper?

ReplyDeleteThe development in Metrotown at the old Save-on-Foods location was apparently "sold out" in a few hours. But a newspaper article that quoted the developer's sales manager later stated that a large number of suites had been "sold" to insiders and relatives of the builder and developer. If the sales are not arm's length then are the sales really legitimate? I have to question how many units there are really "sold".

ReplyDeleteAll developers usually keep a few units and sell few at arm's lemght - nothing new. The sales are reported to increase % sold in order to prove what a great value it is....and it's if you a developer.

DeleteI work in a field consulting to the development industry. Sat in the meetings; heard the discussions. I am somewhat familiar with this project. They most likely did sell out. They sell to investors; the target here were asians.

DeleteHad a co-worker who told me about a friend of his from Hong Kong who flew in 1/2 year before the 'sold out' grand opening and bought 10 units at this project. He got a special price for buying in bulk. By this time the developer had already achieved the % pre-sales needed for financing, so this HK fellow didn't even have to put any money down.

This is the way the development industry works. They use pre-sales to get financing and pass on the risk to the investors. Perhaps some developers hold some units back, but there's no real reason to, they sell at cut rates to these investors anyway.

Main thing is, this 'sell out' didn't happen in a weekend, they started rezoning that 4 years ago, and were lining up buyers then, during a different market.

This isn't news, it's the way things get built. Surprised there are folks who don't know.

The units at the Coal Harbor project are most likely being marketed by Aspac for some 'un-named' investors who got caught as, oops, the market turned before they could flip upon completion.

southseacompany, your insight is helpful but the explanation doesn't really make sense. If investors did not complete the purchase then the units are not sold. There's an awful lot of units here, which at least as of Feb 26 were not sold, and the developer claims in their advertisement that they are now sold. It's hard to believe.

DeleteSince that building started construction in 2008, I find it a hard to believe that the developer would still be holding on to units. The owner's name is listed as 'not available'. There's nothing saying Aspac still owns these units.

DeleteMy guess is that Aspac are allowing their address as a contact for these owners. Aspac may have offered management service and future RE sales service as part of the pre-sale deal.

There is a way, for a fee or if you are registered, to look up owner of title through the Land Titles Office. If someone can do this, then this is the best way to confirm.

You find it hard to believe? I don't. In 2008 th global financial system crashed and we haven't recuperated. In fact, it's getting worse.

DeleteDo some research, you'll find lots of dead bodies in closets of companies since 2008.

They would have been marketing units 2005-2008, before starting construction, before the sales office opened, and before the crash.

Delete"More spacious, more exclusive, and more luxurious than anything seen in the city to date, the residences at One and Two Harbour Green quickly sold out during their pre-sales period. In fact, the penthouses in both towers set record selling prices for Vancouver, sealing Harbour Green’s reputation as some of Vancouver’s most exclusive and sought-after waterfront real estate."

ReplyDeleteThis is a quote from their website, I am really interested to see more findings about this.

http://www.vancouversun.com/homes/Coal+Harbour+Three+Harbour+Green+delivers+spectacular+panorama/7610862/story.html - According to this website in November 26th, 2013 86 homes remain for sale.

Website also does not indicate that its sold out.

I love this blog. Thanks to you and the anonymous tipster for another great piece. I'll also point out another example of this was Telus Gardens. See the video, "Telus garden condos did not sell out":

ReplyDeletehttp://www.ianwatt.ca/Blog.php/hey-vancouver-sun-telus-garden-condos-did-not-sell-out

evelopers have to pre-sale most of the units, perhaps 80%, in order to get financing to build. They may not have pre-sold all, but would have had to pre-sale the vast majority. Developers start signing up buyers during the rezoning process, which can take two years, and then another two years to build. Hence the 'sold out in weekend' propaganda; they've actually been marketing these units for years. They usually sell at 'wholesale' prices to investors who buy blocks of units. The more you buy, the lower the price. Pre-sales have been a whole different world than re-sales. Developers pass on the risk to these investors. The recent 'sold outs' are actually the result of a market from, perhaps, three-four years ago. The pre-sales in this building are yesterdays news.

ReplyDeleteIt's unlikely that a building like this would have gone ahead with only 60% pre-sales, especially since 2008. Most likely the building was pre-sold and these units are being marketed for the investors who were looking to flip once completed, and who want their name to remain 'not available'.

Another piece of the puzzle that we don't get stats on is the rate of completions vs. the number of buyers who lose their deposits by walking away from the contract.

DeleteWe have stories in the media both of buyers suing developers to break contract, and developers suing buyers for breach of contract, but we don't have any idea about how many presales just end up back on the market.

The whole point of pre-sales is to put them back on the market, either sooner or later. Pre-sales aren't bought by end-users, but by investors. They park their money there for a while, and either hold and sell later if they forsee appreciation, or dump them if they think the market is tanking.

DeleteYes, claiming sold to meet construction financing conditions is the underlying reason developers do this.

DeleteI would guess real estate agents are often times the buyers.

The other question here is why would a lender advance funds in this situation? They don't care? It's close enough?

That tells you the profits these guys are making. 65% - 80% is the break even point; after that it's gravy.

DeleteI would think the reality is that if a glossy print ad even gets you a slight bit interested and you have 22 mil to waste then - you and ASPAC deserve each other - really deserve each other.

ReplyDeleteGreat investigation again.

Cheers,

Thank you for the report. The public is apparently misled by all these sales tricks. "sold out" does not mean it is sold out.

ReplyDeleteSo, does it mean that by the time a project becomes available to the general public, most likely it has already sold 80% to some major investors? And the people lining up are buying the remaining 20%?

ReplyDeleteWhy is it that the real estate industry pretends to be so transparent when it comes to residential sales, but the condo presales are a dark unknown exclusive secret society?

Short answer...yes. Or they're lining up to create hype for the 2nd Phase coming soon.

DeleteThey are exclusive because folks like you and me don't have the cash to buy 10 units at a time. And developers can't sit around waiting for Joe and Jane Average to slowly buy up 120 pre-sale units in a tower.

Developers sell wholesale to investors who then turn around and, eventually, sell retail to folks like you and me.

Hopefully, in a few years, the retail price will be less than the wholesale price! : )

Investors who buy bulk into presales take on risks too. Higher risks than those who buy near or at completion. Naturally they are entitled to greater returns - or loss.

DeleteFor more on how it's done, from a 2008 CBC Marketplace show;

ReplyDeletehttp://www.youtube.com/watch?v=SNyltNIHhgs

Shows what cheap cheap leveraged paper money will do to a world!What a mess,condos should be able to be built without spec investors from other countries.

ReplyDeleteSure, condos 'should' be built without investors. But a 25 story tower can be 120,000 square feet of floor space. At $300 to $400 per square foot construction cost it can cost up to $40 to $50 million to build. Developers can't up-front that kind of cash, and even if they had that kind of cash on hand that would be quite a risk. And what bank would give you $50 mil for a building that 'might' sell?

Deletesouthsea,

DeleteGiven your apparent deep knowledge about the RE industry, you must know that ASPAC is owned by the Kwok brothers in HK who are the majority owner of Sun Hung Kai Properties, which as of the last annual report holds about $2B CAD in cash.

http://www.aastocks.com/en/stock/companyfundamental.aspx?cftype=7&symbol=00016

How much did you say a building cost to build again?

SHKP is a listed company with shareholders. Their shareholders would never allow management to leverage its own balance sheet to fully finance a project when investors and banks are more than happy to take that risk.

DeleteVillage Whisperer and Blogs putting media to shame with real investigative reporting.

ReplyDeleteThis development is by no means sold out ASPAC has much deeper pockets than most developers around town. They're able to sit on these units and hold pricing at $1900/ft. It's well known in high end real estate circles in town that this development hasn't been selling well at all and there are a lot of units available for sale. I sense some RE industry mis information in the comments above, don't beleive them THIS IS FRAUD plain and simple. Selling luxury is all about creating an aura of exclusivity, tough to do when you've only sold 58% of a building. The RE industry needs better regulations, it's shameful.

ReplyDeleteThere's no mis-information. I've been on these blogs for years, check out my youtube site, I've been posting bearish stuff for a long time. I work close to the industry, but I rent, as I believe there will be a correction.

DeleteI just want to educate folks on how the industry works. There is no conspiracy. It's the way that development gets done. They use their own money to buy land and pay for the rezoning process, but to they all get investors on side and then go to the bank for financing in order to build.

Three Harbour Green started construction ion 2008, so they were selling pre-sales for a few years before that. I doubt that the developer would still have units on hand 5 years after construction began. Perhaps, but unlikely.

Most likely, these belong to some investor(s), perhaps offshore, who is(are) using Aspac's address as a contact.

Really...I mean Really??

Deletesouthseacompany:

DeleteLink for your youtube site? or blog?

Whisperer,

ReplyDeleteHad an interesting conversation at a "new" open house in the OV this weekend. It was with an agent of an RE co. I didn't recognize and he was quick and proud to tell me his company buys 50 units at a time before the neighbourhood comes together and then resells them later. At a profit, I presume. But who knows with the OV!

He said they own hundreds of units downtown. Basically they take the spread between the before and after in a neighbourhood, some they sell, some they rent out working with other groups like Crosby. He said they got all the OV units at a bulk discount weeks before the went on wide release at their new, lower properties.

He liked talking about it so much, I bet he'd talk to you. If I see the sandwich board out there again next weekend, I'll post his contact info here, if you want.

In BC, "sold" does not mean "completed". It is considered sold for the purposes of the Real Estate Board reporting purposes when a contract is firm without any further subject conditions. In this way, market information made available to the public is much more accurate than if it is reported only once completed with title changing hands. Around here, with a six month closing, we would all be operating under false and outdated information were we to rely on "completions".

ReplyDelete