The ongoing saga of dwindling available Silver for delivery on the COMEX continues unabated as the demand heats up.

After yet another day of withdrawls, the total amount of registered Silver drops to a new all-time low of 26,814,648 ounces!

The pace of silver depletion in the registered category is nothing short of astonishing. If it were to continue at the pace it has been on since March, the COMEX would literally be depleted of registered Silver to make deliveries within 250 days.

It is interesting to note, however, that the eligible catagory of Silver on the COMEX has increased. While not available as Silver that can be delivered to settle contracts, the total now stands at 101,719,841 ounces.

Not surprisingly, JP Morgan and the Commercial shorts have been adding to their net short position as Silver's price has been going up. Presumably that pace will really pick up next week as they desperately try and keep the price under $40.

As a percentage of total COMEX inventory, the short position is up to 185% from 164% last week.

As a percentage of Registered Inventory, JP Morgan and the Commercial shorts are now short 699% of the registered Silver category - a level which is almost the highest ever.

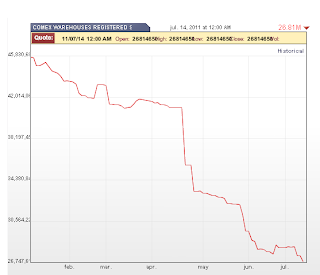

Below is a graph of the Registered Silver Inventory for 2011. Since January inventory has dropped from over 45,800,000 ounces to 26,814,648 ounces today (click on image to enlarge).

Below is a graph of the Registered Silver Inventory for 2011. Since January inventory has dropped from over 45,800,000 ounces to 26,814,648 ounces today (click on image to enlarge).

It's important to note, the significance of this inventory decline on the COMEX is not that the world is running out of silver, far from it.

It is that the amount of silver available for sale, in large quantities and the appropriate forms, is in increasingly short supply, down to record levels AT CURRENT PRICES.

This is significant for two reasons.

Such supply/demand imbalance, in the absence of supply or demand shocks, is often the result of long term artificial price manipulation and external forces in the market that prevent a market clearing price.

Eventually the market imbalance will be resolved, one way or the other. The banking cabal has tried to create available Silver by crushing the price downward in a hope Silver holders would dump their physical Silver.

That has not only failed to materialize, but Silver supply has actually tightened.

The shortage of Silver at the COMEX can be resolved with a significantly higher price. And I believe we are going to see that in the not too distant future.

It appears things are heating up again for another possible big breakout in Silver price.

It is that the amount of silver available for sale, in large quantities and the appropriate forms, is in increasingly short supply, down to record levels AT CURRENT PRICES.

This is significant for two reasons.

Such supply/demand imbalance, in the absence of supply or demand shocks, is often the result of long term artificial price manipulation and external forces in the market that prevent a market clearing price.

Eventually the market imbalance will be resolved, one way or the other. The banking cabal has tried to create available Silver by crushing the price downward in a hope Silver holders would dump their physical Silver.

That has not only failed to materialize, but Silver supply has actually tightened.

The shortage of Silver at the COMEX can be resolved with a significantly higher price. And I believe we are going to see that in the not too distant future.

It appears things are heating up again for another possible big breakout in Silver price.

==================

Email: village_whisperer@live.ca

Click 'comments' below to contribute to this post.

Please read disclaimer at bottom of blog.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

Did you have a listen to Ben Davies on King World News today? He certainly sounds upbeat to this affect saying "Its happening now", and $2,100 gold in four months. I find it bizarre that I hate seeing the price rise. I guess I understand now that it will happen... there is no two ways about it... it will always be a case of ... if I just had one more year.

ReplyDeleteThere never seems to be enough time to prepare.

ReplyDelete